Retrograde analysis, a tool, and a mindset to deal with high uncertainty

These last weeks have been, hectic and you’ve seen me posting a bit less than usual. Among other things, I spent quite some time giving webinars to a few of our industrial customers in Europe. The need to address innovation programs retooling is quite pressing for everyone.

A part of these webinars is private and concerns their business and processes in some cases. Still, I can share the part about the mindset and the tools such as retrograde analysis that becomes more important than ever.

(You can also check a Twitter thread version of this post here.)

Crisis, forecast and disproving them

To start with, it’s worth remembering that the Covid-19 crisis is not the subprime crisis of 2008 all over again, with its financial domino effect. It’s far worse because it’s directly connected to all our global production and supply chain, to tourism and hospitality, food and agriculture, and of course, healthcare. (Here is a more extended discussion on the nature of the crisis here if you need a refresher.)

Long story short, we’re in it (a global recession) until a vaccine starts to be widely distributed, which means 2 years, to be realistic. Until then, anything goes in the markets, and if you think you can forecast what’s going to happen… you can’t really, can you?

Now how to address that?

Well, by doing a forecast, of course. And no, I’m not joking. Even if no one can forecast what’s going to happen within 6 months (and even less so two years from now), it’s still important to make predictions. The reason is that we still need to move forward and have an opinion about it.

But there is a twist now…

The twist is not to believe your forecasts anymore, instead try to disprove them.

In another article on the Covid-19 crisis, I did most of the job for you on key issues with the PESTEL framework (Politics, Economy, Society, etc.). You don’t have to trust me (you shouldn’t), and you also should look at your own market with more focus (my analysis was comprehensive).

So what’s the point of these forecasts if you can’t trust them and want to disprove them? They give you reference points looking ahead. The hypotheses that are framed precisely set a vision of the future that you can assess:

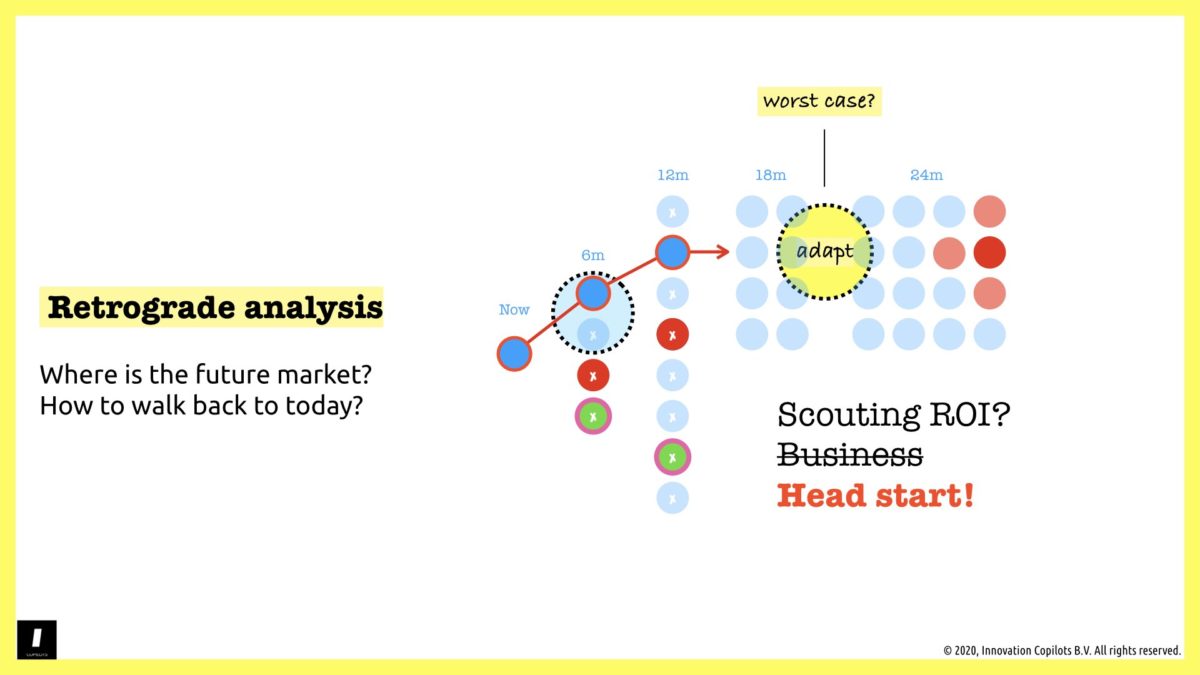

Doing such an exercise is key when you do retrograde analysis, which is one of the key tools you might want to consider to rebuild your innovation program as we speak.

What is retrograde analysis?

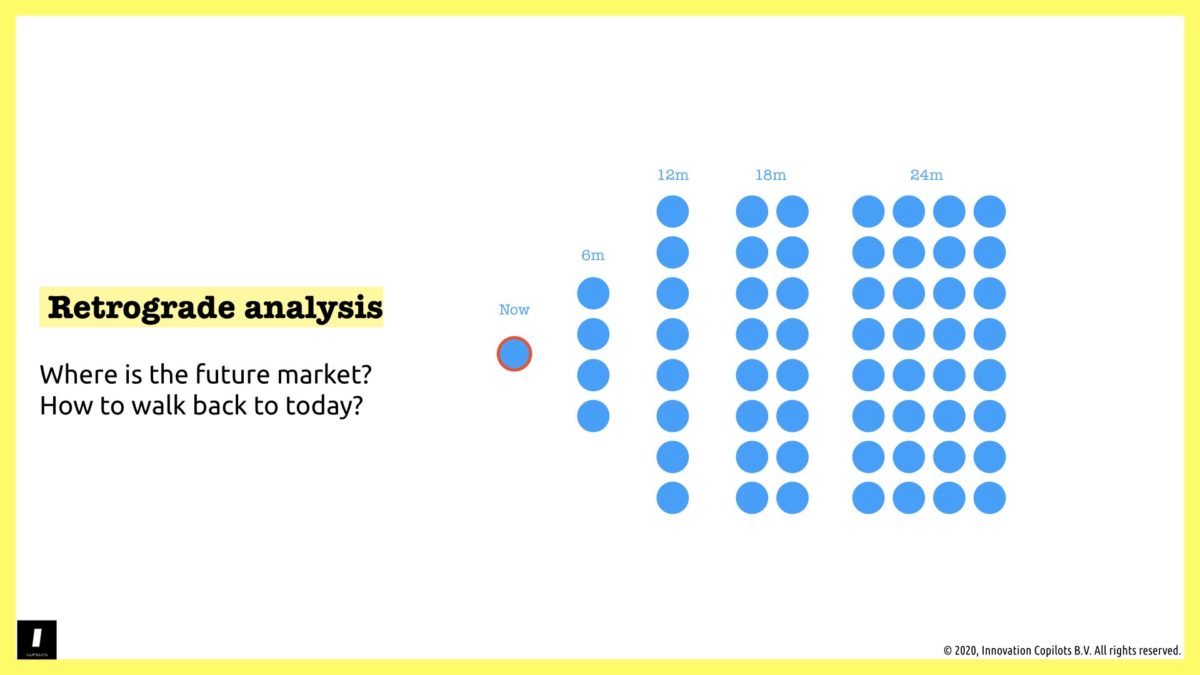

Imagine a high complexity game such as chess. After each move played, possible scenarios branch out exponentially. What high-level players do is not follow-up on everything and anticipate millions of moves. They try to anticipate what are the most favorable outcomes 10 or 20 moves ahead.

First though, they map out the key possibilities from the current state of the game:

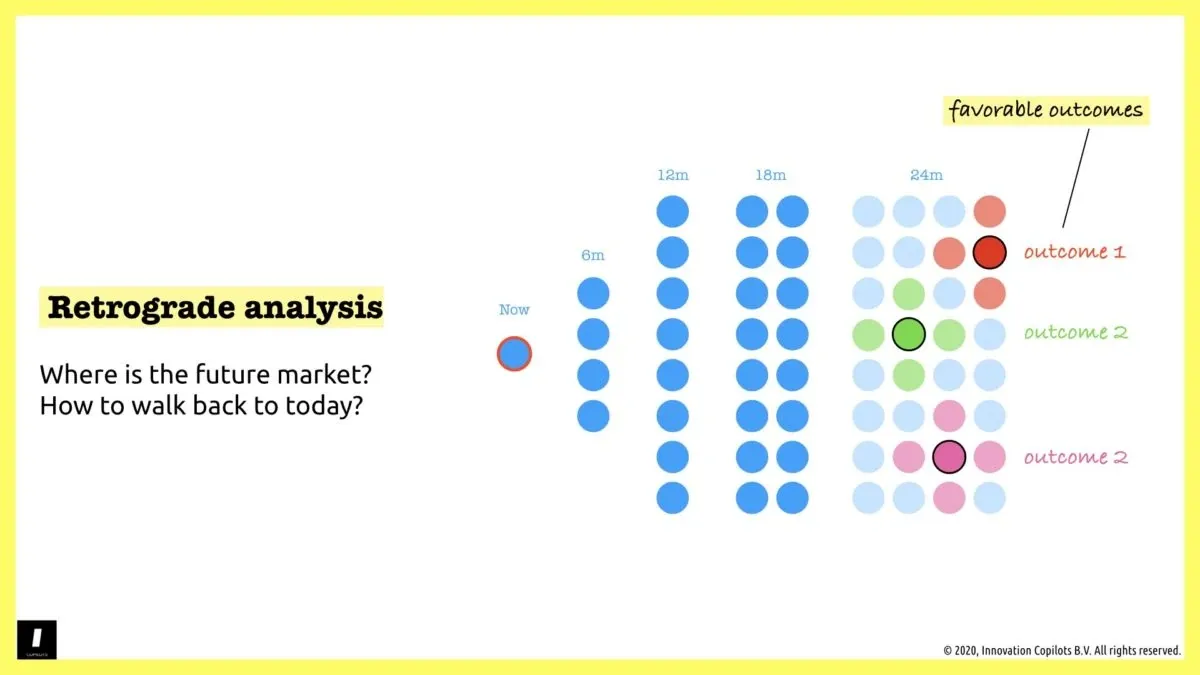

And then they select a group of outcomes that they’d like to nudge the game toward (note that there are a central outcome and a few others that are the possible wiggle room):

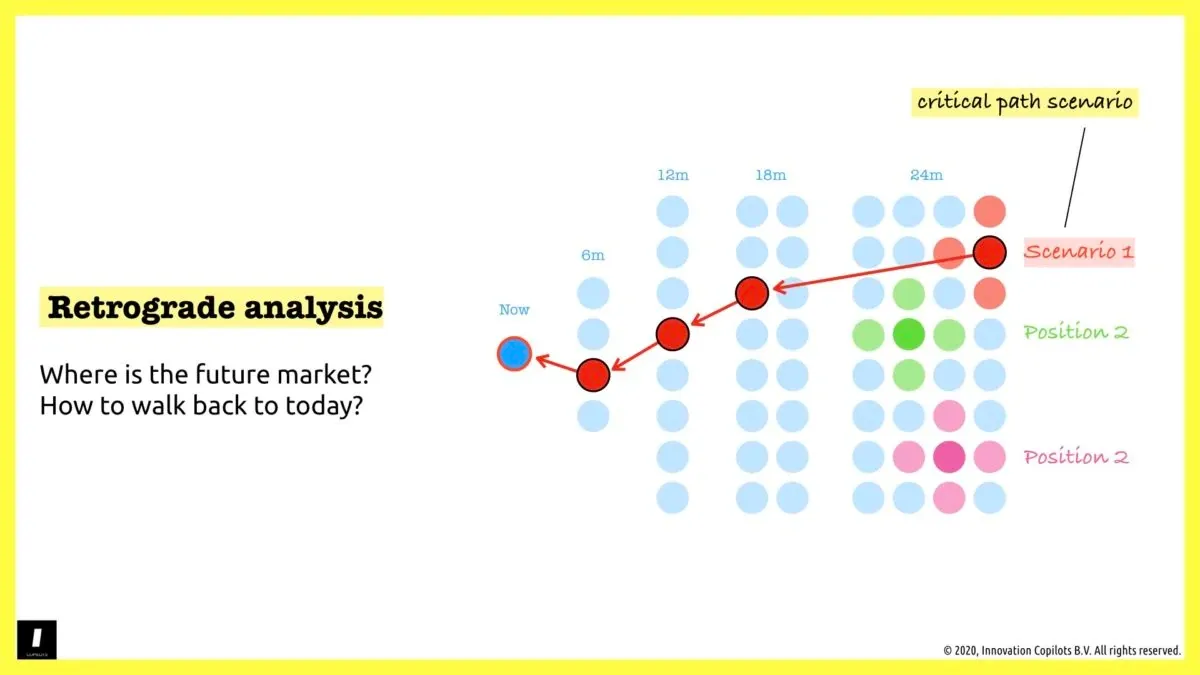

From there, they walk back to where the game is right now and determine a critical path (this is the core tactic in a retrograde analysis):

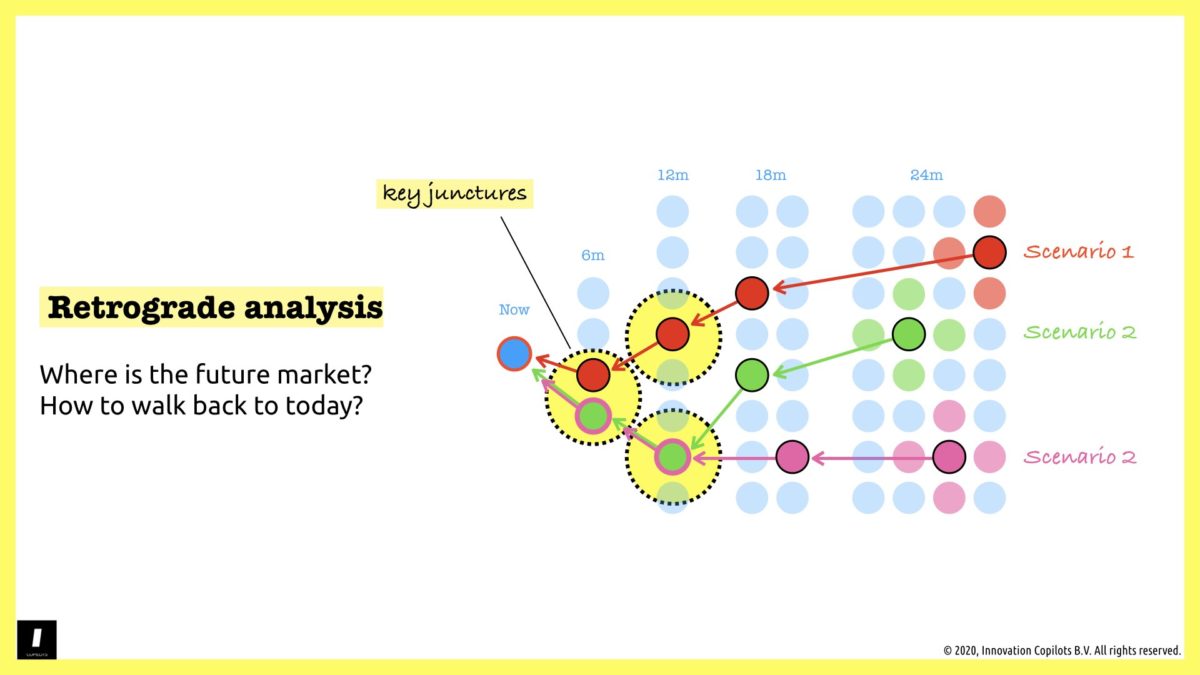

They then end up with a few key junctures just 2 or 3 moves ahead that are necessary to go through if they want to reach their end game much later in the game.

Retrograde analysis reduces the complexity of looking far ahead of us in a complex game, to a few necessary preliminary steps that could unlock favorable outcomes:

If the player manages to push the game in one of these key junctures, he starts to control future moves and narrows it down to a favorable end-game position.

The market is not a chess board

Now, of course, we’re not playing chess in business. And you certainly don’t just have a single opponent to outsmart in front of you. The market, especially in crisis mode, is not a zero-sum game. And for the next two years, it’s not just complex but chaotic.

If my chess comparison falls somehow flat, we still can use such a retrograde analysis thinking. Because we can’t control the game doesn’t mean we can’t explore the game.

As a business, if you walk back to today the predictions you can have about different outcomes in your market two years from now, you will too end up with key junctures. Bottleneck moves or decisions that will shape the future and push the market up or down, right or left.

I’ve discussed autonomous cars in the past. If you believe that two years from now, they are a consumer product, then in the next 3-6 months, where are the countries or cities opening their legislation to advanced proof of concepts? Taiwan, Singapore, Helsinki, or Portland? If it doesn’t happen, this market will not be ready by 2022. And if you want to know if you need to invest as planned on this by the end of the year, check these programs by partnering up with startups, working with one of your customers on such governmental research programs, or at least do interviews to understand where this is going.

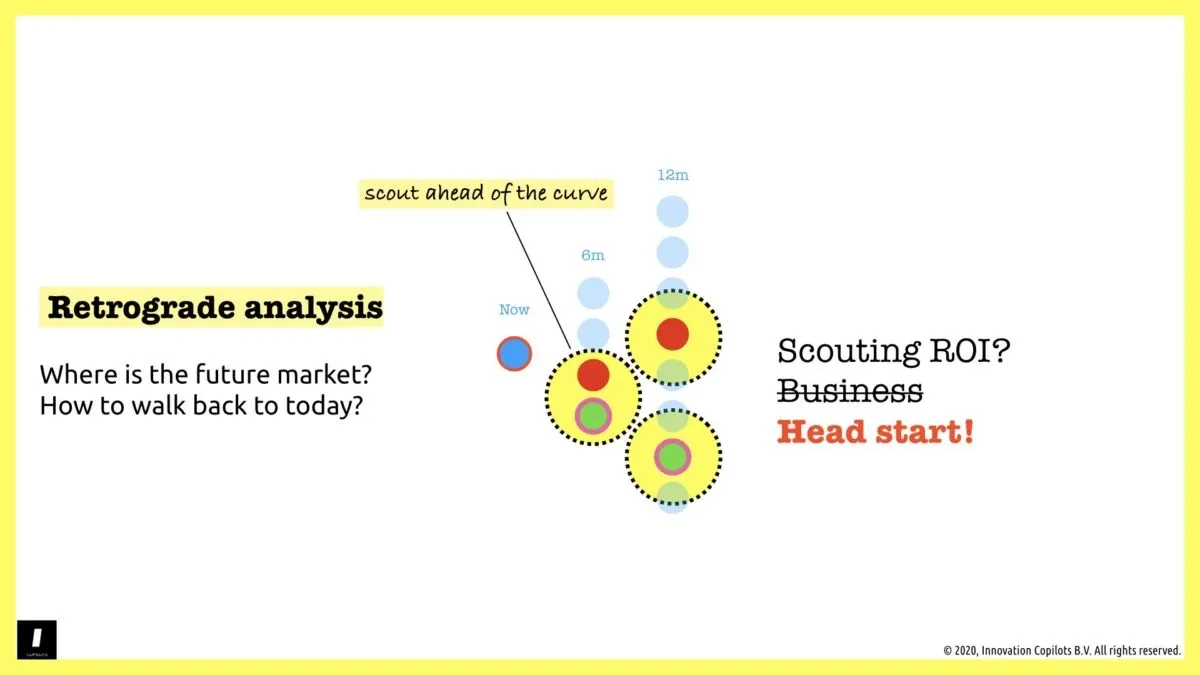

This retrograde analysis will produce key intermediary scenarios that you can scout ahead of the curve. You don’t need them to succeed or earn your revenues. You’re certainly not making a business plan on them to build multi-million dollar revenues. You need them to tell you if a possible future market can be unlocked timely or not.

Identify the key junctures, disprove them (or not) and get a head start at understanding where the market is going before competitors:

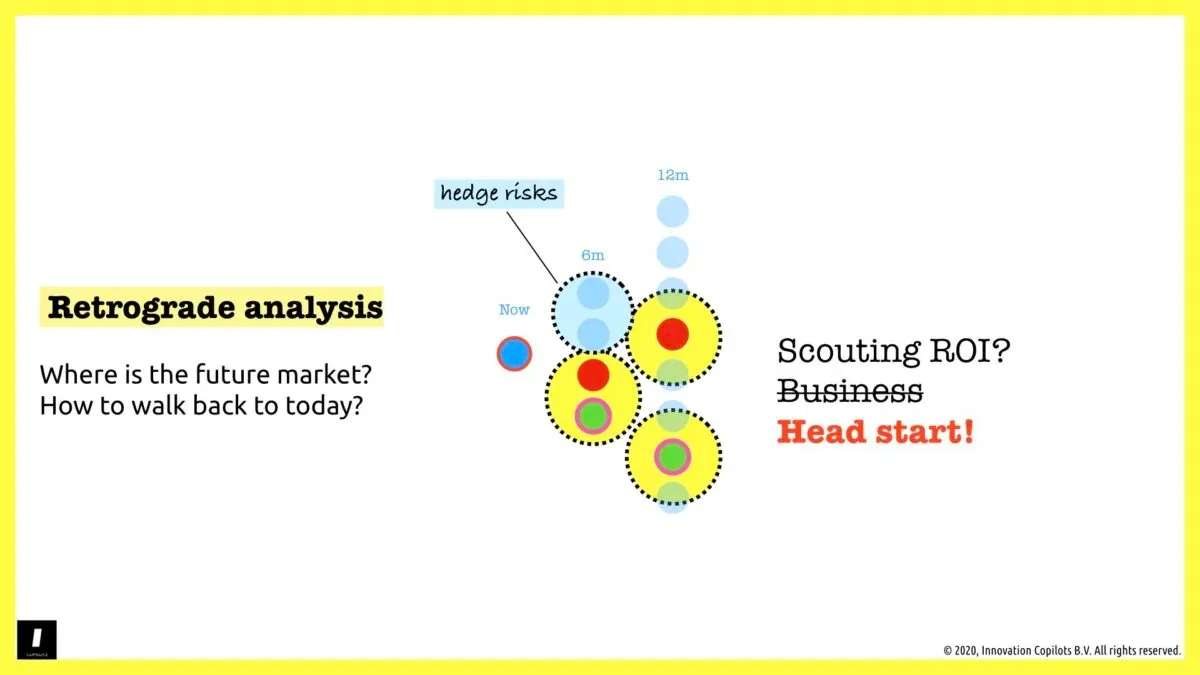

And because we’re not just playing chess, hedge your risks by scouting contrarian scenarios too. Junctures in the market that will close down the positive outcomes two years from now:

Now, if one of your worst-case scenarios is happening, you still have time to shift, adapt and pivot out of lethal sunk costs situation in your core business. Would that be good news? No. But you’ve just survived a drastic turnaround in a highly volatile market (there’s an ROI to that):

Being wrong still pays off too...

If you consider the prediction I had a few months ago (when we only started to learn about Covid-19) that we would be in a 2-year global crisis, I connected preliminary information. I saw it was a network effect crisis and mapped the key junctures. And I was right on many forecasts at this point, wrong a few other ones.

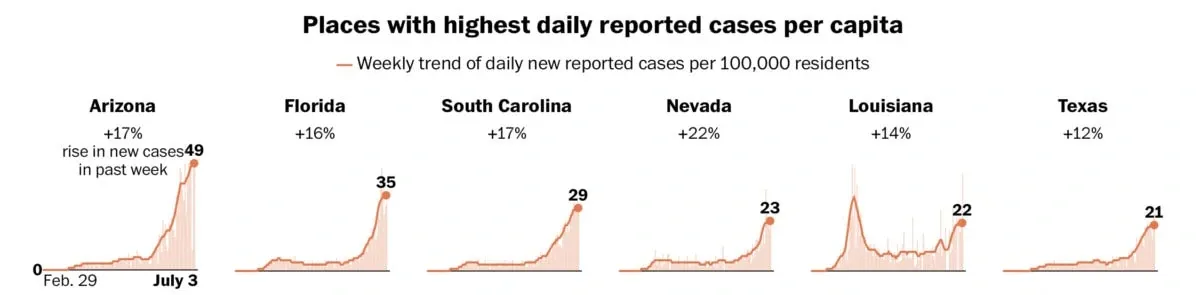

What I didn’t forecast was that the US will fail to raise the healthcare challenge and that the first economy in the world would decide to let the pandemic spread in its population:

This unpredictable turn of events ends up fueling my initial prediction. This means that you don’t have to be absolutely spot on with your forecast; you have to build the main scenario: a long-term crisis and a divergent one: an unexpectedly short-term crisis. The one that will be reinforced had been mapped no matter what, and if you were wrong on the root causes, you can adjust on the fly.

And in this case, this vastly reinforces my on-going prediction about the rise of China as a global technology power for the next 5 years…

A mindset more than a tool

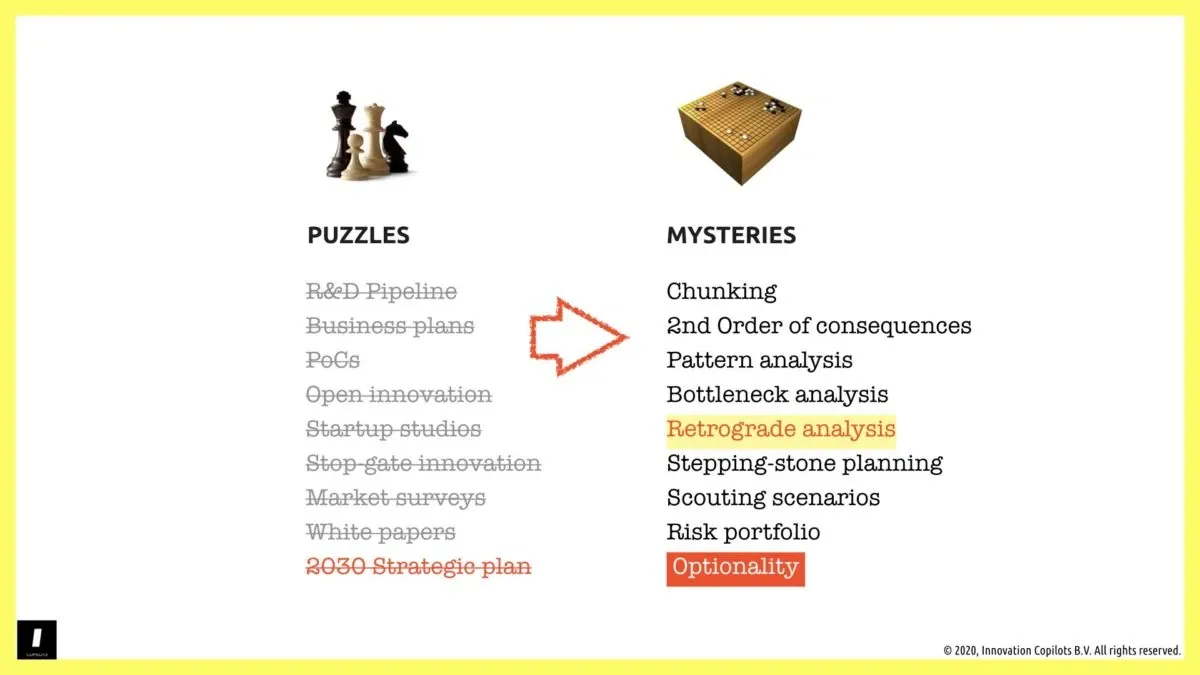

When I present these tools they seem exotic and maybe complicated. Fair enough. Somehow they are, just because we’re not that often in such drastically uncertain times (once every 10 years as it seems?). But these tools are anything but new.

And I keep writing ‘these tools’ because there are a few of them:

Imagine if you never wrote a business plan and never heard of it, and I would ask you to write a detailed analysis of how much money you’re going to make as a business to the cent in 2025… You’d probably think I’m crazy? But just a few months ago, this was business as usual for most corporations.

The only difference? We have a new normal now:

Also, (and I‘ve seen that happening a few times these last few weeks), it’s more than probable that your CEO will remember that a corporate innovation department was funded a few years ago and that you are in charge. And given the circumstances, for once, s/he might want quick and tangible results, which will be anything but new businesses.

What can you deliver to help drive the strategic vision of your executive committee in a few months? Scouting is a safe bet with tremendous ROIs. So maybe don’t get hung up on retrograde analysis; it’s just a tool.

As innovators, we are in a unique position to help businesses face and adapt to the uncertainties that are building up at explosive rates around us. Start rebooting your mindset and your priorities.

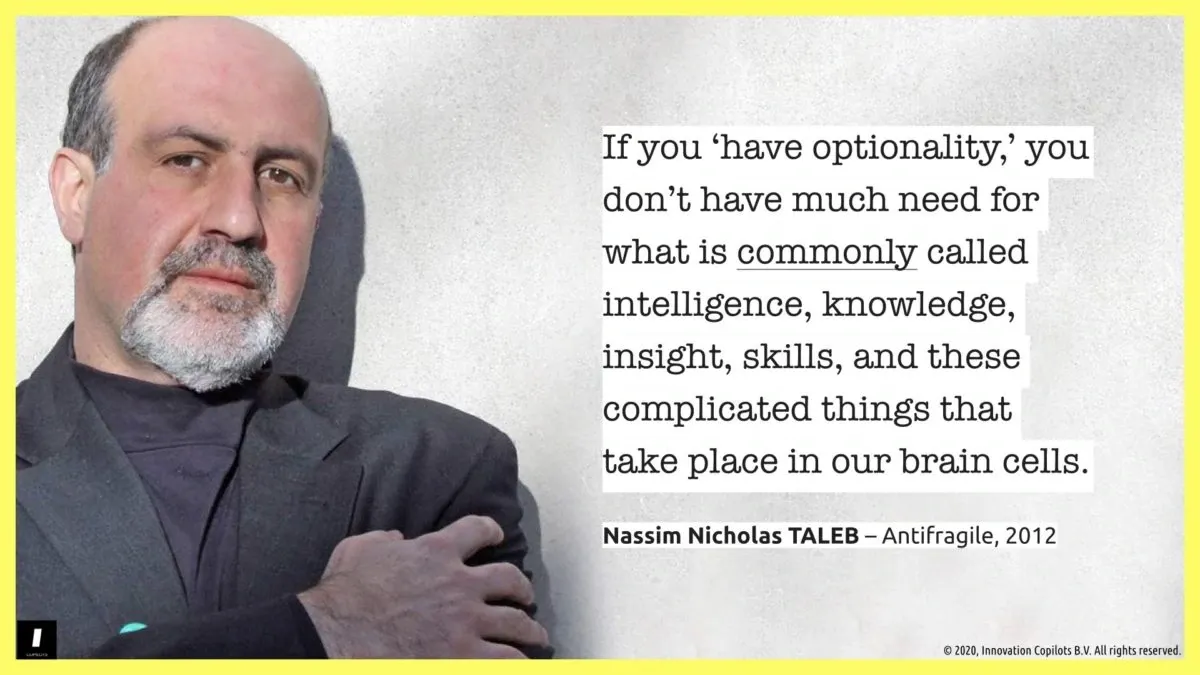

And the beauty (or the horror) of the times we are facing is that intelligence is not the best way to crack such an uncertain future. Scouting, probing, exploring a portfolio of business options before committing to lead the core business right or left, up or down, is the only way forward.