The innovation (portfolio) rule of 120

To properly manage a corporate innovation portfolio, I often refer to the "120 Rule", to explain that innovation is a quantitative game.

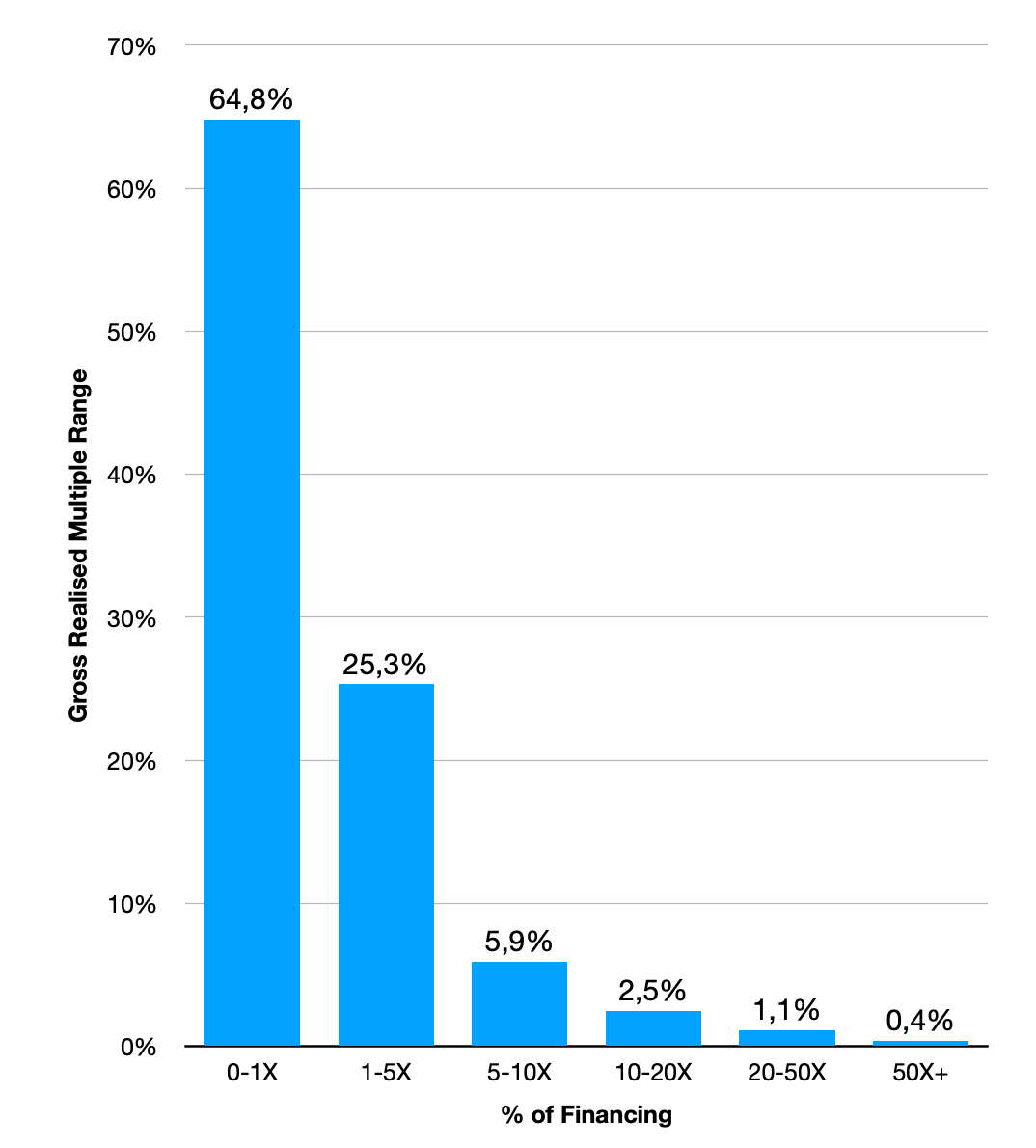

A few days ago, I picked up the following data on the gross multiple U.S. venture capital firms would get on their initial startup investments. This statistic was collected on 21,640 companies that since then went out-of-business were acquired, or IPO from 2004 to 2013.

Granted that, yes, there's now a ten years lag between these figures and our current ecosystem, the empirical power law at play is still valid. Out of a hundred investments, on average, 0,4 to 1,1 "make it big" and are transformational for a business category.

The most common misconception in innovation is that being smart is key. No, it's not. Being smart just gets you on the starting line; then the race is all about volume. If you're not in pure venture capital, the same heuristics apply. Unless your corporate innovation portfolio aims for "120" projects funded or directly managed, your chances of finding the next big thing are non-existent.