Market predictions with systemic bottleneck analysis

A few days ago, I discussed how systemic bottleneck analysis could be a reliable way to make market predictions in a high uncertainty context. While I’m often baffled that consulting firms never really share how the prediction sausage is made, I truly believe it’s important to demystify this work. And let’s not be fooled; making predictions is easy until you have to justify a few down the road why you were predicting things that never happened!

Predictions don’t work, and yet…

Yes, this is my mandatory copy and paste disclaimer when discussing forecasts and market predictions… What’s the point of these forecasts if you can’t trust them and want to disprove them?

And I’m sorry to say that oftentimes corporates are mainly to blame for the poor state of the “prediction market.”

In the early 1980s, AT&T asked McKinsey to estimate how many cell phones would be in use in the world at the turn of the century. They concluded that the total market would be 900,000 units. This persuaded AT&T to pull out of the market. By 2000, there were 738 million people with cellphone subscriptions. (Andrew CHEN)

Companies want to know where to skate next, never really why. As such, they never really build up their 6th sense or compression radar-like detection capabilities and need continuous perfusion of weak signals, trends, and next big bets. Paying big money to Gartner or Deloitte to get the same sectorial info as your competitors seems OK if your exec committee is happy with the reinsurance.

This prediction fallacy is not only due to cultural laziness or short-term corporate political games. It’s also about being able to break out from your incumbent mindset.

Sizing the market for a disruptor based on an incumbent’s market is like sizing a car industry off how many horses there were in 1910. (Aaron LEVIE)

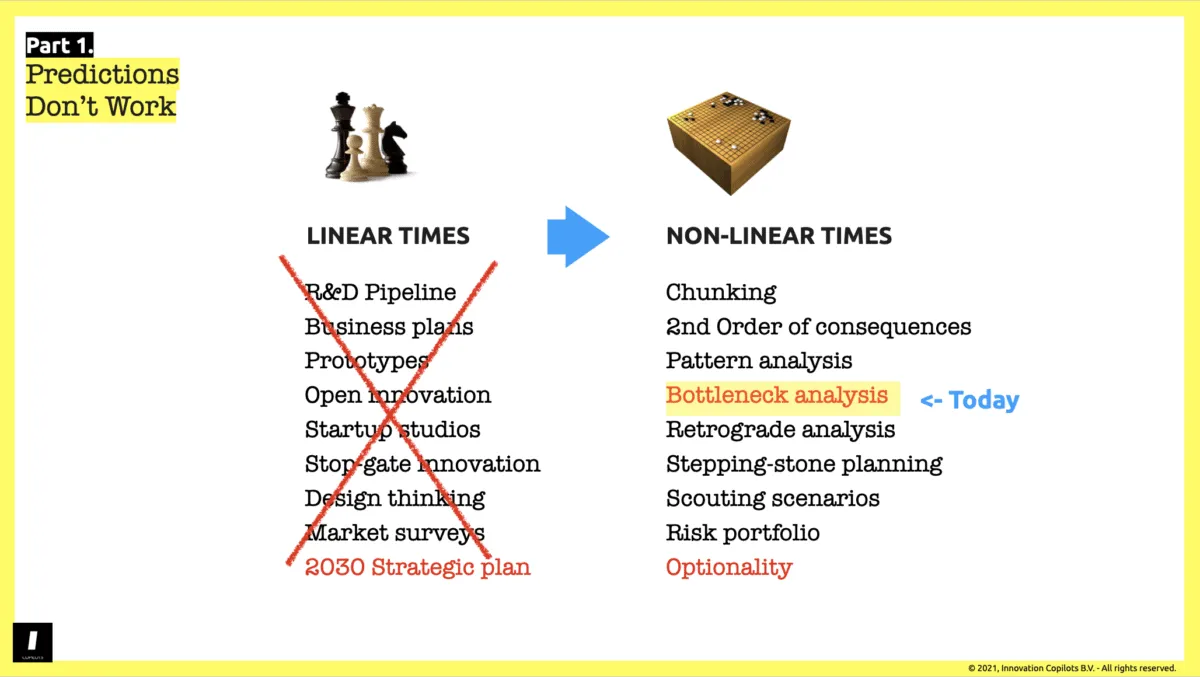

How do you proceed when you understand that the value is in how you build your predictions, not so much the output?

I know that market forecasts are often just made by trying to extrapolate how weak signals and trends would scale up within a few years from now. To put it as nicely as possible, this is a very candid way to work at it (akin to playing investing billions in the stock market just using linear regression).

But it doesn’t have to be. And as already discussed a few months ago, there are many (many) tools and strategies to make predictions and unmask the underlying hypotheses about the market.

Seeing systemic bottleneck

In that regard, systemic bottleneck analysis is rather interesting when markets are all over the place, and no one knows what will happen six months from now.

So what are we talking about?

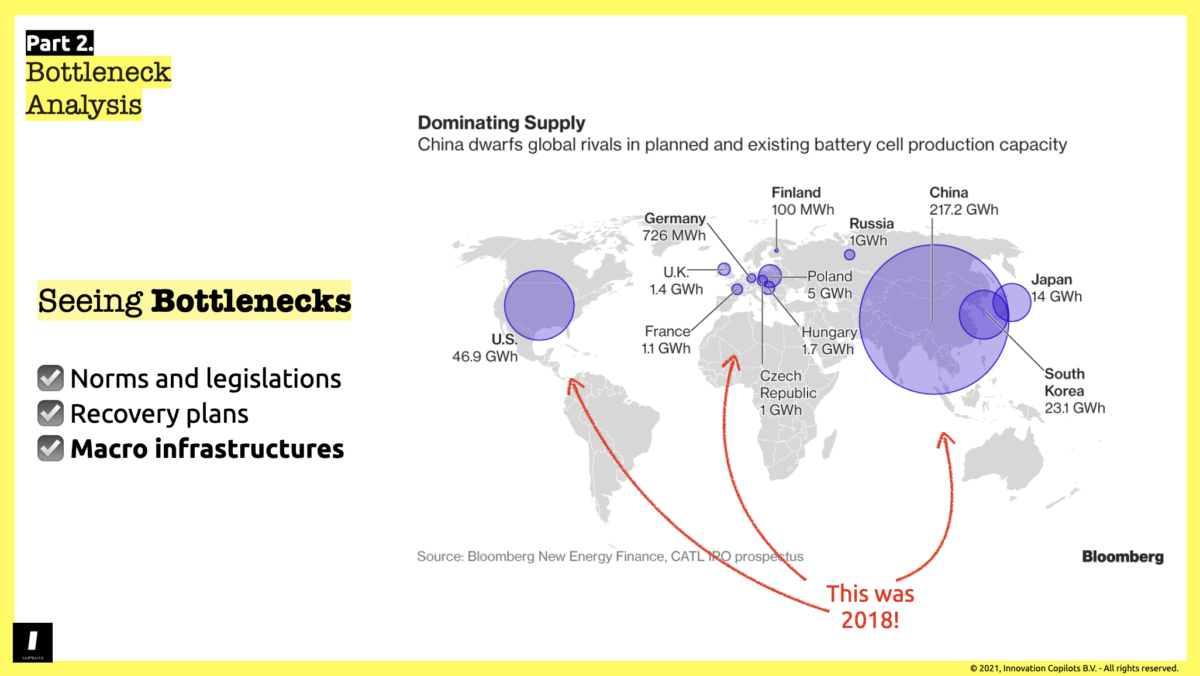

Incumbent players often disregard systemic bottlenecks because they will reshuffle the cards so that it’s genuinely difficult to face them. If you want one of the most spectacular examples of these last ten years, the shift from the combustion to the electric engine in the automaking industry is for sure.

And if you think that what leads to this ‘catastrophic’ market turn point is the rise of consumers buying electric vehicles, you’d be wrong. If anything, consumers behaviors are always a laggard metric and the worst possible one to base forecasts on. The underlying systemic bottleneck is much simpler to see coming: it’s massive, it’s been years in the making, and as soon as it reaches critical mass, no one in the value chain will be able to ignore it anymore. I’m talking about worldwide electric battery manufacturing capabilities.

This is the real systemic bottleneck for the car industry. And it reached critical mass around 2018, pushing China first to massively adapt its automating culture to EVs, while the US and Europe are still slowly shaking out of their state of denial).

In my latest webinar, I briefly discussed three systemic bottlenecks that will impact most markets:

- Tech platforms (GAFAM and BATX) are reaching market saturation.

- Covid-19 pandemic being a new normal for the coming 3-5 years.

- Hardware (not software) platforms are the next trillion dollars businesses.

Understanding them, monitoring their build-up (or not), and already forecasting the directional outputs they will force upon markets is where big money is for most multinationals, but also… startups.

How does systemic bottleneck analysis work

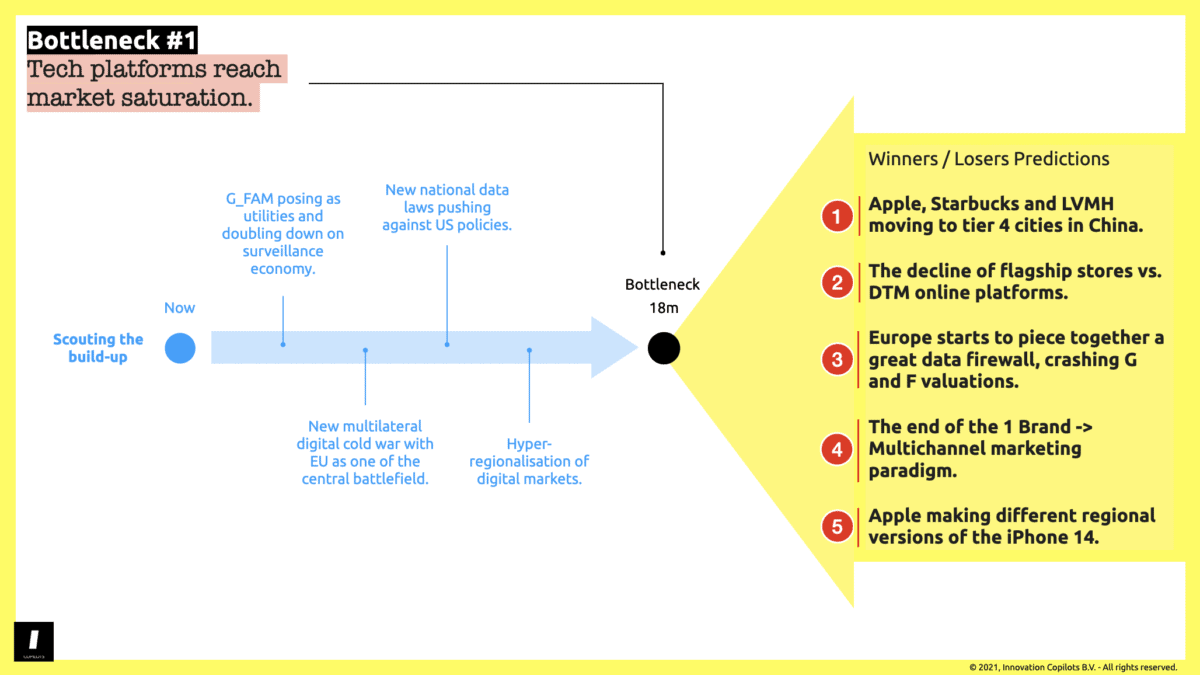

If we consider this first systemic bottleneck: 1. Tech platforms are reaching market saturation. We’ve been seeing its build-up for quite some time now. Even recently, the TikTok ban discussion in the US had much less to do with Trump than with incumbent platforms unable to innovate their way up anymore, which will undoubtedly lead to more and more cold war-like regulatory fights.

Is this bottleneck building up? Like you’d monitor the first waves preceding a major earthquake, just monitor these events. And being smart about it would mean monitoring high and wide to ensure that you don’t miss what is also happening in other markets as well…

Forecasting the outputs

While seeing the bottleneck coming up is the core added value, the less essential by-product is forecasts and predictions. You have to view pushing the logic to the next step and forecasting the second order of consequences of the bottleneck as a bonus :

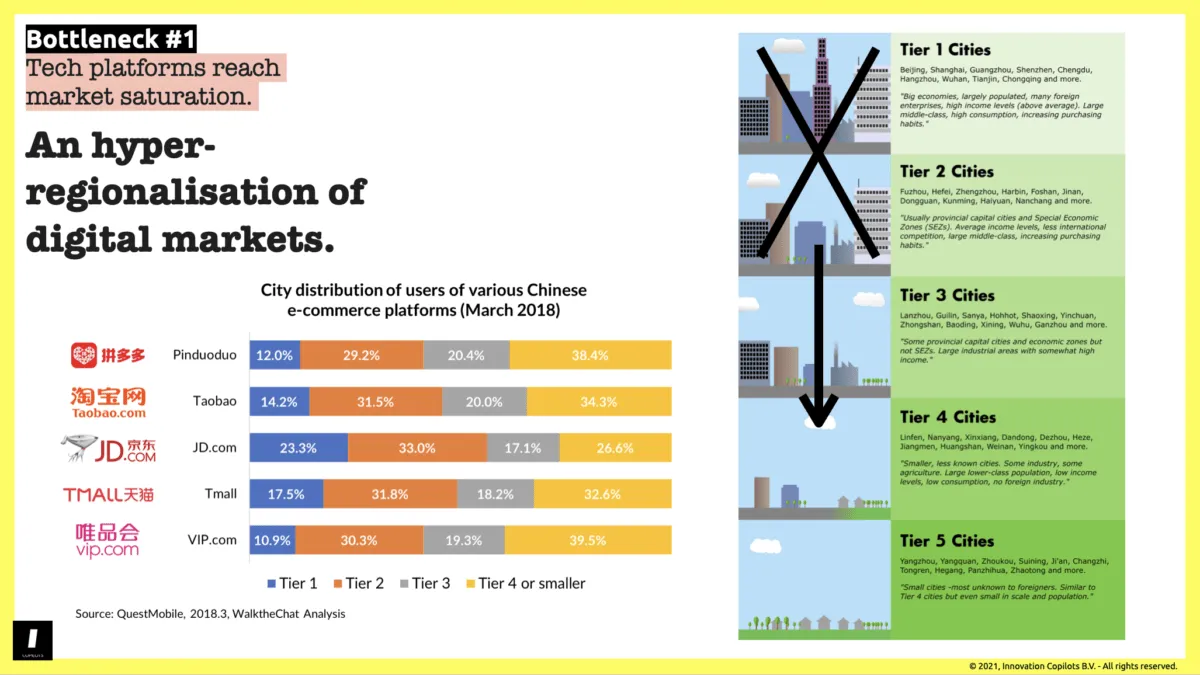

In the case above, the core strategic value is when you understand that all consumer markets will be constrained by increasingly aggressive platforms gasping for oxygen. The growing importance of tier 4 and 5 cities in China will become an obvious input in your next strategic planning if you see this bottleneck coming. Predicting that Apple or Starbucks will first deploy regional networks from these tier 4-5 cities is non-essential. You might be wrong because Tesla will be the first mover here or another western brand entirely. Your prediction would be wrong, but you got the huge market shift right and maybe had a chance to prepare (or even leverage it).

It’s just like predicting that houses number 5 to 10 will be toppled off when you know that a significant tsunami will hit. The core value is in seeing the tsunami coming. Said differently:

How can bottleneck analysis help you?

To conclude this post, let me share three immediate and straightforward deliverables of understanding and applying systemic bottleneck analysis in your business:

If you’re a startup:

- Center your business plan on a clear market hypothesis: What is the systemic bottleneck that builds up in the market you target within the next three years, and how will you leverage it to bypass incumbents’ slower to adapt to it?

- Present rational pivot strategies from the get-go: Even if your predictions on how the market will adapt to the bottleneck are wrong because you’ve seen it ahead of time, how are you prepared to use it differently if need be?

- Target your first key customers more ambitiously: Rather than aiming for more accessible customers for your startup, can you already target some of the big ones in your market? They will have to face harsher consequences going through the bottleneck you leverage. Of course, you might not convince many of them, but getting only one onboard will validate your strategy way more than a dozen unknowns.

And if you’re a corporation:

- Rebalance your innovation strategy: How many of your innovation projects (internal or external) are centered around clear 3 to 5 years of systemic bottlenecks building up ahead of your cash cows? The answer might be “not enough” or “it’s unclear.” This is the easiest to fix critical flaws of most corporate innovation programs.

- Have projects explored different bottleneck outputs, not only a big win hypothesis: Consecutively, how many different outputs are you exploring around a key bottleneck? The usual mindset is to find one big win and get all in. Again, in a high uncertainty context, this is flawed. You cannot predict where the next big win will appear, but you can prepare to react quicker than everyone else and leverage a systemic market turnout.

- Identify the scouting ROI for each innovation project: For each innovation project you’re dealing with (again, internal or external), can you define the ROI of scouting the market ahead of time for your core business units? With a metric?