Covid-19 Crisis, PESTEL Predictions – Part 2

A quick recap on Part 1 key ideas…

In Part 1 of this analysis I made four points about the nature of the Covid-19 crisis:

(1) Plan for major disruption until at least mid-2021. There will be no magical return to normal in a few weeks (maybe September). Past the medical crisis, the global negative ripple effects will be long-lasting.

(2) The Covid-19 crisis is a black swan. Despite what journalists and politicians will try to explain as a social coping mechanism, it can’t be forecasted and you can never be prepared for such events. If ever, it’s the right time to learn from this.

(3) We are misled by a natural rational bias against unpredictable events. We can’t prepare but we can build resiliency or anti-fragility. The good news is that resiliency is a broader safety net than having a specific pandemic plan for the next crisis (which might be entirely different anyway).

(4) This crisis is a network effect crisis. Because of connectedness and exponential nature, it can’t be solved by a simple remedy but requires a cocktail of adjustments, which reinforces 3.

As one of my readers was writing back as a comment by mail « I got it now, it’s not just a black swan, it’s a vicious black swan! ».

Now for Part 2 of the discussion, I will try to map out the key first and second-order consequences you should be aware of for the next 3 years.

For that, I’ll use the PESTEL framework. It is essentially a glorified but very useful checklist that segments predictions in six big boxes: (P) Political, (E) Economic, (S) Social, (T) Technological, (E) Environmental and (L) Legal.

For those of you who have worked with me already and reading this, I’m very often referring to market risks and technological risks with tools such as the M and T radar. In the following discussion: M is P + E + E + L and well T is T!

P – Political impacts of Covid-19

How will the nature of governments change and adapt to the crisis in terms of foreign trade policy, tax policy, etc?

KEY POINTS

1. A new multilateral cold war (way beyond my 3-year horizon).

2. Europe has a unique chance to take over US domination (but might not).

Covid-19 is the first catastrophe of our lifetime that spreads to all countries on the planet within a few weeks. Each country facing drastic shortages of supplies and assessing more directly what it meant to depend on one another will react with an acute form of prisoner’s dilemma. Instead of cooperating at scale (and temporarily renouncing part of their sovereignty), most will decide to close down and rebuild from within.

What I’ve discussed many times about digital sovereignty will accelerate and escalate globally. The three big blocks or factions that will try to insulate themselves more and become self-sufficient will be:

- The US – Trump being re-elected or not, Americans deeply believe their lifestyle and culture have precedence over everyone else. The so-called “Chinese virus” will vindicate this and we’ll see the US morphing from a global power to an insular fortress.

- China – Understanding 3 years ago that the US won’t play ball forever with them had already set things in motion. This will accelerate considerably their investment in self-sufficiency across all markets and technologies.

- Europe – Although Europe should be the obvious player in this game of geopolitical consolidation, it remains to be seen if each individual country within Schengen will accept this new world order and be able to play as a team. This is anything but a given, and the most well-accepted scenario is a few countries with the strongest economies knitting together closer links, while the weakest economies are kept under a modicum of protection with basic trade agreements.

One rapid key outcome will most definitely be the rise of more tariffs around the US, but also in the Eurozone and China.

In this multilateral cold war, Africa, small Asian countries and India will be regional bargaining chips that the three blocks will try to pull in their gravity well (allowing them to avoid their tariff pressure, opening up IP and resources). Expect, for instance, the Chinese Silk Road initiative to accelerate and accrued interventionism from the US in South America.

Saudi Arabia and Russia will try to remain relevant with even more political activism and disruptive influences all around the world.

It’s also important to take notice among all the Covid-19 coverage, that an unprecedented global war on oil prices has been raging between Saudi Arabia and Russia. In this game, the US have a lot at stake as the largest oil producer. I’m not sure that the US government can address so many “war fronts” at the same time (or even just one), but this will also play a dramatic role in the way the 3 central powers are going to realign against each other.

Going back to Europe, no one is betting on us right now. Too much bickering, dissensions, struggling economies in some cases, the on-going Brexit telenovela, refugees flooding from war-torn zones, and so on.

But unlike the 2008 crisis that was purely financial before hitting the real economy, this crisis is first and foremost about healthcare and social protection. This is where we will have a better resilience than everyone else. Because we didn’t entirely destroy our public services and we still have high taxes across the board, we have a chance to get back in the game earlier than the US and China. I know, I’m being fairly optimistic. Nonetheless, we won’t have to bail out families from personal bankruptcies from hospital bills…

Was it a bad idea for the UK to push through in the Brexit rabbit hole? If you had any doubt, the answer is now pretty obvious isn’t it?

As side effects, dictators and populists will also get out of the closets within months and try to seize power. This also means that a second mandate for Trump is clearly on the table.

I understand that this is not a positive scenario I’m painting. But it’s probably the most consensual one and I would dare say, the easiest to predict. Nations and cultures don’t reinvent themselves overnight. They behave with excessive predictability.

[ EDIT – April, 17 ] Emmanuel MACRON in an interview for the Financial Times is the first head of state clearly addressing the reality of a new world order coming up: «I think it’s a profound anthropological shock. We have stopped half the planet to save lives, there are no precedents for that in our history. But it will change the nature of globalization, with which we have lived for the past 40 years . . . We had the impression there were no more borders. It was all about faster and faster circulation and accumulation. There were real successes. It got rid of totalitarians, there was the fall of the Berlin Wall 30 years ago and with ups and downs, it brought hundreds of millions of people out of poverty. But particularly in recent years, it increased inequalities in developed countries. And it was clear that this kind of globalization was reaching the end of its cycle, it was undermining democracy.”

[ EDIT – April, 21 ] In the news cold war’ discussion: Trump is now (temporarily?) closing borders for all immigrants. When airlines will have to reopen between countries at different stages of getting Covid-19 under control, this will get uglier.

[ EDIT – April 21 ] On my « pessimistic » September horizon for a partial reopening of societies and normal life, more studies are coming in confirming it.

[ EDIT – May 28 ] One month after this article the huge surprise is that Europe has indeed decided to kickback. France and Germany are leading negotiations across the board to reboot the EU project. This is admittedly the best news on the horizon by far in this global crisis.

[ EDIT – June 30 ] I might have been wrong about Europe and that would be wonderful news.

[ EDIT – July 16 ] The European Court is dropping the US-EU privacy shield agreement. This is a bombshell news.

E – Economic impacts

How the global economy will contract or expand, which countries can be leading or trailing right after the crisis?

KEY POINTS

1. We’re heading into a 2 year recession period.

2. Most of the 2008’s tech economy boom will slow down or plain stop and we’ll see a return of the dinosaurs (with a twist).

3. B2C Startups will enter a “nuclear winter”.

The first thing that might seem obvious is that many companies will disappear within a few months.

I already pointed out in Part 1 that the level of free-cash-flow has been historically very low in all economies. The 2008 crisis has driven crushingly low-interest rates and it was until now financially irresponsible not to be fueled by debt. Very few companies will be able to endure more than 3 months of depleted (or inexistent) sales.

Only when the tide goes out do you discover who’s been swimming naked.Warren BUFFET

It’s actually difficult to fairly predict the extent of this wipe out.

This will depend on the level of debt and deficit that governments will accept to get into. For democracies, this will largely be decided by the timing of the general elections in each country and the best way to manage public opinion. Early elections will imply generous and extensive bailouts. For elections happening later, citizens will feel the pain through their tax returns and will be more sensitive on how their government spends budget, which will lead to much more restrictive bailouts. The central regime of China that still manages cautiously public opinion but don’t face such an electoral process, will be able to take a much harsher stance on which companies survive or not and fare better after a year or two.

For the global economy though, there will be a hard-hitting recession. The standard calculation applied by economists on a large-scale crisis such as the Covid-19 one is one month of crisis translates into two months of recession before recovery kicks in. Medically speaking the horizon of recovery is when broad vaccine availability is achieved (12 months). Which translates economically in 24 months of recession.

Just as in 2008, quite a few large companies in catastrophic shape will be again deemed too big to fail and will be bailed out. Not only that, entire sectors filled with slow-moving incumbents (real estate, hospitality, agriculture, food production, banking, and insurance) will be seen as much more important than before, but also as more secure assets to invest in for a year or two. Until recession fades away and irrational speculations kick back in, investors will flee tech (and what I call pizza-delivery projects even faster) and go back to more traditional businesses. This is what I call the return of dinosaurs. Ironically enough, this might be the time to invest back in Boeing a few weeks from now…

GAFAM and BATX will largely be in their own world as the digital dinosaurs they are and will be an investment refuge for a large part of the financial markets. Expect sharp ups and downs with an overall steady and strong value in market cap.

That being said, is it good news for these “dinosaurs” that have largely refused to evolve for more than a decade and embrace digital? Certainly not. This time around their bailout might come with quite a few strings attached. They will be under pressure to go through a fast-paced sink or swim transformation. Not all dinosaurs will be saved and the ones that will survive will undergo drastic phases of consolidation and “clean up”.

Will car manufacturers be finally forced by governments to adopt electric vehicles as their new core business? Too soon to say, but it might just be possible.

For small and medium-sized companies, the ones that associate critical skills, a solid customer portfolio and a modicum of brand recognition will rapidly be absorbed or will consolidate. Probably a lot of opportunities there but only if you already had that before Covid-19. Not as something that you can really set in motion in the next few months.

On the private investment side, it will also be the return of the eighties: investing in R&D, science, and patents whenever possible. Yes, pharma and Medtech will do great. But also everyone developing technologies for automation, industrial production, and supply chain when every country will try to relocate productions and assert more sovereignty on the “real” side of the economy (more on that in the Technology part).

For now, most startups and investors will put a good face and pretend to be optimistic, trying not to rock the boat too hard. In truth, investors will shift to more resiliency, less explosive return on investment. The time where money was easy to access, burn and refinance is gone for 3 years (then people forget and other bubbles will appear).

As a consequence, it’s hard to imagine how most VCs would be able to refinance their fund for the next two years (80% of them in Europe have been swimming naked for a long time). Private accelerators are mostly dead in a matter of months while public incubators will be the new black in Europe and the US.

So yes, a nuclear winter for startups and a drop-down of at least 25% smoothed out over the next 3 years in startup investing, with a sharp 50-70% decline until Q1, 2021.

https://t.co/UvKJsuR1L6March 28, 2020

As a last note on the post-Covid-19 economy, two types of countries have a chance to fare better than others:

- Social democracies with extensive unemployment and healthcare benefits if they had a strong economy to start with to weather the recession as much as possible.

- Singapore and South Korea that have already built a degree of social immunity with the Severe Acute Respiratory Syndrome (SARS) of the early 2000s and will adapt faster to Covid-19. (Honk-Kong and Taiwan also, but they will be inexorably reined in central China).

In all the tech investment discussions that you will see floating around for the next few months, always remember that a large part of the initial money is coming from the real economy and especially real estate. As such, here’s a handy rule of thumb: when the housing market will bottom out VC will see money flowing back after a year or two.

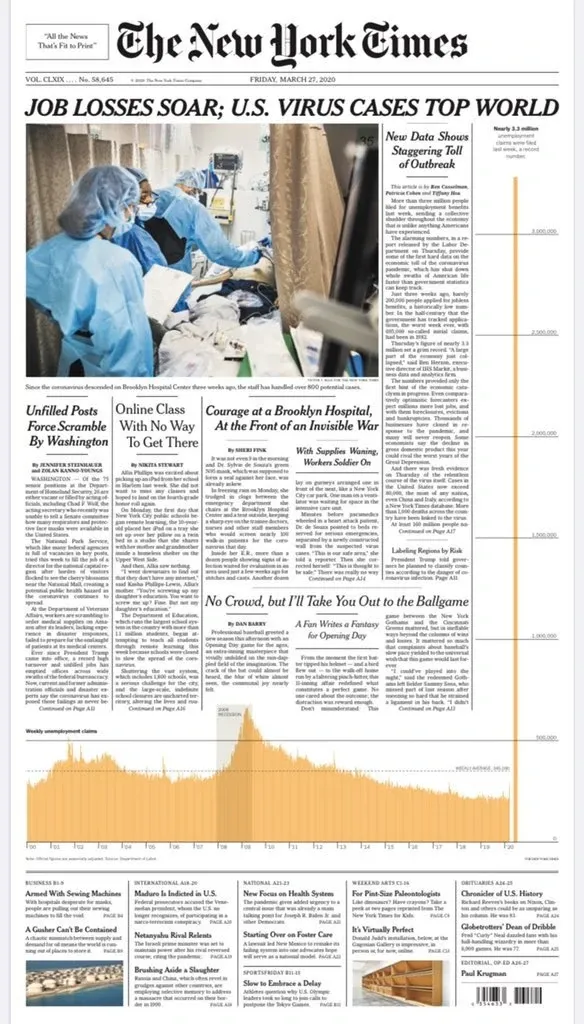

In any case, no question again that the US will be hit the hardest by the recession as the largest economy with so many external trade dependencies (even with Trump at the helm since 2016) and such a disastrous lack of social infrastructure.

[ EDIT – Apr. 30 ] I was (sadly) on point on the GAFAM as stock market darlings. Incredibly, so. But again expect share ups and downs…

[ EDIT – May 2 ] I was way too optimistic about vaccine availability. I’ll have to adjust to 3-5 years and still be optimistic about it. Mind you, this doesn’t change the short term perspective of us being in this crisis past the end of the year…

S – Societal impacts

How will societies evolve and shift during and after the crisis? What are the new values and behaviors to expect?

KEY POINTS

1. Containing unemployment will be the overarching theme.

2. Risk-aversion will drive the global consumer mindset.

3. Sustainability and eco-responsibility will be shut down in the short term.

Unemployment concerns all over will not only reshape the job market but also the way people will value work all over again. As very few of the many who will return to the job market will be successful freelancers overnight, the return to the cozy pencil-pushing jobs in large corps will be the new sexy. Associated with it, expect a dire psychological price to pay for Millenials who were promised to be retiring at 35 after landing a VP job in a tech startup. If it’s difficult to predict what form of resentment will build up for our young adult generation, this will be their Vietnam war to some extent.

Remember in this context that one of the deep social consequences of bailing out Wall Street in 2008 has been the rise of the Tea party and the far right in the US. Powerful global social resentment against globalization will be rekindled. With Covid-19, if nationalism and protectionism don’t explode at first they will inflate steadily, which is for Europe a central concern.

Risk-aversion will be in any case the new normal across all types of consumer markets and the return to traditional values, feel-good products, and family-oriented brands. Which as always in these times will mean some compensation by significant progress in the luxury market.

Even if laptop sales have been up quite a lot these last few weeks, all this will eventually translate into cutting down most of the consumers’ appetite for innovation and novelty technologies. But broadband, videoconferencing, cloud storage, and digital media are from now on the bottom of the Maslow pyramid with water, flour, and toilet paper. For our society, the internet is not « technology » anymore.

https://t.co/awqCZAsqC2March 31, 2020

Expect big tech corps such as Google, Facebook, or Alibaba to adjust accordingly and position themselves more and more as plain utility companies.

The central unknown for me is how much will the US learn from the Covid-19 pandemic and adopt more of the social-liberal healthcare system that we enjoy in different forms in Europe. I wouldn’t hold my breath on this, but still, something will have to give in the hardcore everyone-for-himself-you-have-to-earn-it American culture.

[ EDIT – April 13 ] As predicted, Hermès recorded a breaking $2.7 million in sales last Saturday after its flagship Guangzhou store reopened (for reference, this is a Tier-1 city of more than 11 M people).

[ EDIT – April 19 ] Amazon moving in to offer healthcare coverage for its sellers. This is straight out of Alibaba’s playbook and another step at being a utility company and a public service.

T – Technological impacts

How will the technology sector fare and where will be the expected winners and losers?

KEY POINTS

1. End of party for unicorn B2C startups.

2. Back to hard tech and science.

3. GAFAM pushing in the surveillance economy.

Has previously hinted, startup valuation will plummet and last year’s unicorns that haven’t raised money in the last 6 months will see their valuation be divided by two. The ones that will be the more impacted are the ones that have bet on network effects in the B2C market and that were playing winner takes all (Uber, Airbnb, and co).

B2B and B2G (business to government) companies like Space X that provide key strategic technologies enforcing national sovereignty will be the new Airbnb and Uber.

As pointed previously, the GAFAM and BATX platforms will become even more prominent as « utility companies » also providing backbone strategic technology.

About these platforms, expect in the US two forces opposing each other:

- On one hand, public money pouring into the platform and the US government becoming more prominent stake-holders, balancing the need of breaking their monopoly or leveraging their public power.

- The platforms themselves wiggling out of this by (a) providing key services to the US government (more on that below) and (b) interlinking themselves together to show that they are not purely walled gardens (read what Amazon and Apple are starting to do as we speak in that light).

Another significant shift for platforms such as Google and Facebook will be a decisive and methodically organized step-by-step untangling part of their business model from ad revenues.

https://t.co/FG4lZwq3A9March 31, 2020

This is now a matter of short-term survival and also of post-Covid-19 resiliency (something that we will also address in Part 3 of this series).

For all the reasons above, it would be remarkable that the GAFAM don’t tread the waters of cautious citizen technology at first and move on progressively to full-fledged surveillance economy solutions. Think some opt-in only apps for anonymized contact tracing to « help us » fight Covid-19 kicking back next winter, and backstage more and more Palantir-like solutions for governments.

BATX? They paved the road since 5 years ago. It’s just accelerating from now on starting with satellite countries.

Now in a broader perspective if I had to shortlist 5 promising tech sectors for the next 3 years I’d go with:

- GAFAM and BATX for all the above reasons, plus their huge amounts of free cash flow that will make them an ideal refuge for investors.

- Real estate market where so much money is sleeping. While it has been shaken by Airbnb, Airbnb is now shaken in tow. Opportunities will arise in terms of peer-to-peer mortgage financing, new forms of rental with the option of purchase, and so forth.

- Hard tech (also known as ‘science’) on backbone technology ranging from energy to supply chain, automation, and agriculture. Expect many ventures in creative combinations such as delocalize self-efficient automated greenhouses.

- Social tools for healthcare such as personal monitoring devices, mail-order self-diagnostics, home care systems for elderly citizens, etc.

- Urbanism and mobility which are essentially not talked about right now in term of sectors ripe for reinvention. Probably again because these last 12 years for a startup to be sexy it had to go in B2C (network effects) and not touch problems with long-term payoffs. This changes now.

Let me also point out a few tech sectors that the media currently list as winners and are anything but: videoconferencing (will revert to normal when unemployment will reach unprecedented levels), AR and VR (still no killer use case even now!), home and food-deliveries (will go down with the economy), sharing economy (not only for obvious prophylactic reasons, but essentially because of global social risk-aversion) and autonomous cars (I was bullish on them since 2018, but the market priorities are now entirely reconfigured).

The big unknown for me is education. At this point I can pretty much defend both sides of the argument: it’s going to disappear as we know it and be rebuilt from the ground up OR it’s such a conservative social construct that it will stay as it is with some minor adjustments (more online homework’s and a crunch on programs such as MBAs which could essentially become legacy luxury products).

[ EDIT – April 10 ] It wasn’t too long before Apple and Google, the most antagonistic platforms of them all, decide to join force and offer a Covid-19 tracing tool deeply embedded in their respective mobile OS.

E – Environmental impacts

What will be the priorities or lack thereof in terms of pollution targets, carbon footprint, biodiversity but also sustainability and ethics?

KEY POINTS

1. Environment will not be a priority for most countries.

2. the US will pump more carbon out, but China will strategically reinforce green tech.

3. Indirect positive externalities when rebuilding for resiliency.

While I’m trying not to be overly negative, it’s difficult today to predict that environment will be on top of the priority list of governments and businesses for the next 3 years.

The optimistic case to be made is probably two-fold: (a) Citizens all over the world have measured the positive environmental impact of traveling and consuming less and (b) Governments will try to rally everyone around a green new deal to relaunch the economy.

The difference between an optimist and a pessimist is that the pessimist is usually better informed.Clare BOOTHE LUCE

For Europe, I sadly believe this is extremely wishful thinking and that reality will kick in very fast. In a kind of bottom-of-the-Maslow-pyramid mindset, most societies will focus on sustaining their family through the crisis and will accept any form of a solution that will allow them to maintain their pre-Covid-19 way of life. But also, consumers have measured the amount of trade-off they had to endure to see a positive impact on carbon emissions and pollutions in general. Renouncing Amazon’s same-day deliveries is easier said than done.

As such, don’t expect that citizens will be determined to focus on ecology, sustainability and renewable energies for the next few years. If Europe would have already launched some form of global initiative and it was starting to pay off, maybe it would have survived Covid-19. It will be difficult to make the case for it now with GDPs falling down, less investment budget to get there, and still no clue on how to get a wide consensus around it.

Feel free though to trust that a few countries in Northern Europe, with solid social cushions to weather the brunt of the crisis and that already well engaged in green enraged development will follow through. This will be a minority.

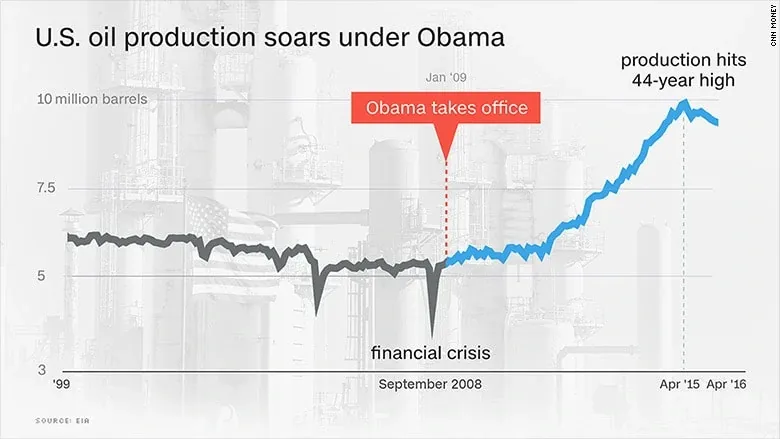

For the US no one will be shocked when they will solely focus on the DOW Jones, unemployment, and GDP at all costs. Before you start bashing Trump (you should for so many other reasons) remember that it was the very climate-conscious Obama’s administration that deregulated fracking shale oil to push the US as the first oil producer on the planet:

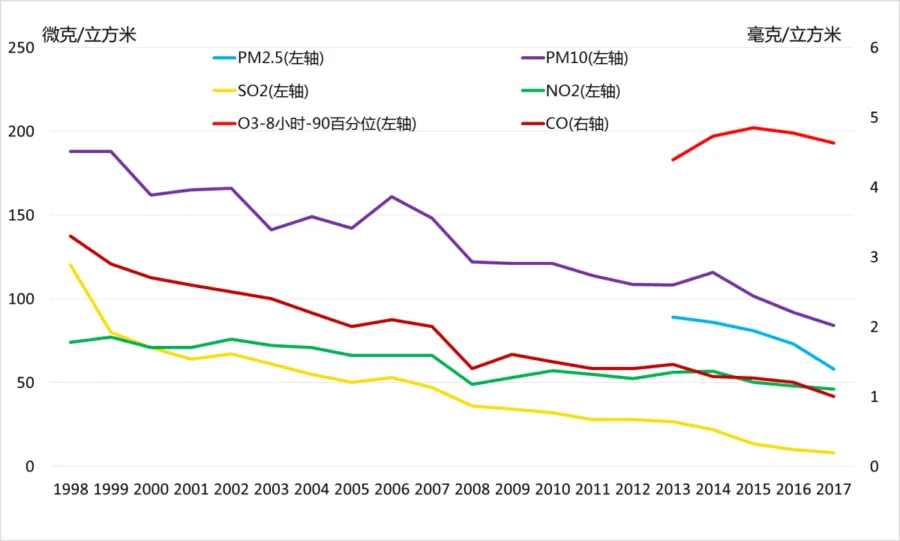

China which is anything but a role model for environmental concerns has nonetheless been extremely active at pushing massive investments in pollution reduction in Tier-1 cities well before Covid-19:

It’s only fair to expect that China having already measured how green energy reinforces GDP, boosts employment, and strengthens national sovereignty. This will accelerate even more post-Covid-19. This translates into aggressive exportation of nuclear, solar, wind, and tidal energy systems, paired with electric mobility and smart grid technology (which is nicely intertwined with « citizen » technology).

That being said we shouldn’t plan for complete ecological disregard either. Building new resiliency in the economy paired with the need of strengthening sovereignty will mean relocating back local productions. This could mean a rapid surge in green and Agrotech innovations, for which the Dutch model has already paved the way in Europe.

[ EDIT – April 14 ] Here again you might want to monitor how Chinese consumers are reacting in Wuhan while things return to a new normal. 3 Words: more car sales.

L – Legal impacts

What are the potential changes in employment, consumer protection, or health and safety laws to expect after the Covid-19 crisis?

KEY POINTS

1. The era of acceptable global surveillance.

2. Bailouts with strings attached.

3. New employment practices.

Lawmaking is certainly the slowest force in motion when you’re considering a strategic analysis. Well, in the case of a crisis such as Covid-19 it does accelerate pretty fast. The main reason is that politicians find a common enemy that requires them to regroup beyond party lines if only to reassure citizens and protect the stock market’s mood.

Another reason is that said citizens living in democracies will accept more readily game-changing legal measures that would normally require general elections to pass on. Incidentally, being « at war» with Covid-19 rapidly became a central narrative:

The situation is serious. Take it seriously. Since German unification, no, since the Second World War, there has been no challenge to our nation that has demanded such a degree of common and united action.Angela MERKAL – March 18, 2020

In that context expect an on-going erosion of individual civil rights that will be done on a temporary basis at first (« It’s only to flatten the curve ») and then extended (« The coronavirus might come back next year »). At the moment one of the inception points of such measures is contact tracing to enforce social distance. This logic will then spread extensively when airports will have to be reopened and controlling passengers’ cross-borders will become a healthcare necessity. Over time it will be natural to link medical and travel data with some sort of biometric recording.

The way we accept the use of personal data at scale is going to change too. We previously addressed how the GAFAMs will see this as an opportunity to offer data monitoring but they’re not alone. Global surveillance specialists like Palantir are already active behind the scene to come to the rescue of countries outside of the US and telecom companies are readily playing that card as well.

So yes, it was only a few months ago that Westerners were shocked by the social scoring system that China was slowly testing and extending. A form of this will be acceptable soon. Maybe not with giant screens shaming pedestrians jaywalking, but certainly with a deep impact on how we can be traced and monitored at an unprecedented level.

If GDPR survives this, it will be extensively rewritten to accommodate for the sake of on-going emergency preparedness.

In terms of trade laws, it seems unavoidable that Europe will reinforce taxes against US digital platforms, not only the GAFAM. A multi-lateral cold war is fought in many ways but it needs to be legalized. In the context of the World Trade Organization (WTO) attacked and defunded by the US, a new world trade order will be in the making. Chances that China buys in legitimacy and plays at the side of Europe to create a new WTO, are high.

As new trade borders and alliances are raised, new targets will be painted on the back of the US platforms. Expect politicians like Margrethe Vestager in Europe to collect more and more momentum and make a global coalition for GAFAM digital tax possible before 2022.

Another important change in tax law might be the strings attached to all the massive corporate bailouts in preparation. In the US, an increase in corporate taxes will seem suddenly very acceptable to both Democrats and Republicans after the elections (whoever is elected). But it’s also reasonable to expect new rules on dividends and stock buy-backs. A more open question is how far will governments go to ensure that the bailout money is not going straight back in the pocket of shareholders, but indeed sustain business activities and employment? Some countries might be prone to simply nationalize key industries like airlines or car manufacturers. Will the US do this to Boeing (which they logically should at this point)?

In regard to work regulations and employment laws, all signals will be soon on green for significant changes. Granted that this will be the slowest moving legal domain, many things will have to give here too and adjust to a post-Covid-19 era. For instance, compensating for the surge in structural unemployment for 2-3 years while sustaining household consumption and the housing market, means reinforced social support. Yes, even in the US. But it also means more and more adjustments of pension laws and legal age for retirement in most countries. And as part-time jobs might be the norm for most populations, more granularity and fluidity between freelance status and full-time status will develop.

At this point, it’s probably difficult to say if these new laws will represent a net positive for everyone, but the macroeconomics constraints and the adjustments they will require for at least one generation are inescapable.

Conclusion

I’m not going to pretend that predictions are not a dangerous game to play. But it goes both ways: not predicting is pretty dangerous too.

Everyone has a plan until they get punched in the face.Mike TYSON

When punched in the face, it’s true, your plan is shattered. But this plan, good or bad, gave you a framework of key assumptions on the future. As soon as the plan is invalidated, if you know and understand these assumptions, you’ll find yourself able to reassess and redirect your strategy way faster than everyone else.

This is the essence of strategy. Having a plan because you understand it’s rather useless, except for mapping the key junctures you need to monitor going forward.

If there’s only one thing that can be useful in me laying out these predictions of the next 3 years after Covid-19, it is benchmarking and assessing on your own the key junctures I’m mapping for you. And seeing the ones I’ve been forgetting.

Lastly, my personal feeling is that the key take-away of all this should be that Europe is at an unprecedented juncture. There is a road where Europe can push ahead of the US through this crisis by ‘simply’ staying the course and keeping its social values. Reading a lot about US politics since Trump abysmal arrival to power, it is absolutely mesmerizing to watch how this super-power is grasping for oxygen. While the US are sinking lower and lower every day — while, expect for true DOW and the NASDAQ until now — their only utopia and promised land, their next frontier has essentially been us. Europe.

The Covid-19 crisis is certainly a dramatic strain on our European economy and society, but we are as a collective way more equipped and resilient than the US (or China) to resist and come out both reinforced and vindicated in our vision of society.

Will our politicians take the cue, look beyond their usual short-term horizon and get out of limited damage control? I don’t know. I’m even a natural self-declared pessimist on this one.

But still, our opportunities out of this punch in the face, again, are just unprecedented.

In the next (and probably last) part, I’ll discuss how you can build resiliency in your business, strengthen leadership and brand value and plant the seeds of anti-fragility in your corporate culture.